The Effects of COVID on Commercial Real Estate

No one can say how long it will take for the history books to be written about the effects of COVID on Americans, from unemployment rates, to education, to family planning.

On the contrary, many businesses are already experiencing some notable changes, with not much end in sight, even with the vaccine roll-out. One of these industries includes commercial real estate.

Commercial real estate was definitely one of the most negatively impacted industries of 2020 in numerous ways. In this article, we outlined the various reasons why commercial real estate struggled and why this industry may take years to recover.

Customer Shopping Transitioned Digital

One of the most thriving industries within commercial real estate was warehousing, prior to the pandemic. Due to Amazon’s influx in order deliveries, and brands across the country racing to keep up with the demand, warehousing has had to shift to become an agile and adaptive supply chain element. COVID has only driven this demand forward, as increasingly more brands invest online ordering while customers have started singularly started shopping online.

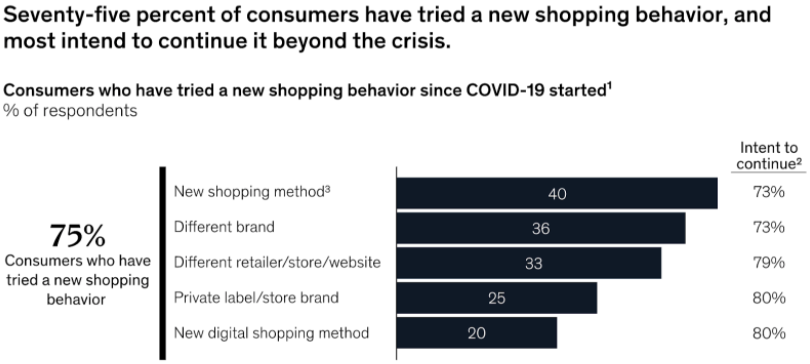

Since COVID started, 75% of consumers have tried new shopping behaviors, many of which transitioning online with little change foreseeable in this trend. Commercial real estate firms will need to adapt to new, and changing, behaviors by offering more warehouse space for online orders and catering to the “touchless shopping” trend that has resulted from COVID.

Employers sent their workers home

Thinking that remote work would only last for a couple weeks back in early 2020, employers started sending their employees home, expecting it to only be a slight inconvenience. After further developments of COVID throughout 2020, large companies like Google and Twitter have announced that employees will start to work remotely permanently. If businesses across the country follow this model, as they likely will, this shift could hurt commercial real estate as it pertains to office spaces.

With this being said, a remote workforce means a smaller office space. If you have a 20 person team, but only have your 5 top team members working in the office, smaller office spaces with a focus on meeting rooms and common spaces could make an upcoming as companies look to continually cut costs.

As developers look to build more commercial office space, going forward, they may be more inclined to break up office spaces into several smaller units instead of just 1-2 offices on each floor. The future of the workplace, as well as the future of work, remain uncertain, but businesses are already beginning to adapt to this new way of work life.

Businesses of all sizes have closed their doors

As the cash flow worries continue along with government related lockdowns, businesses are struggling to pay their recurring bills. However, some businesses have closed completely for a majority of 2020, with continued limited capacity in the foreseeable future.

This is not a minute detail, as Yelp’s Local Economic Impact Report suggests that 60% of businesses that closed their doors in 2020 will not be opening their doors back up. This permanent closure of 60% of brick and mortar businesses will have a significant impact of the commercial real estate sector.

Furthermore, the continued push to remote working, these vacant properties are unlikely to fill up, resulting in empty lots in cities nationwide. This increased supply of vacancies will drive down rental rates for these spaces as landlords are trying to fill these empty buildings.

Experts from CBRE Group told Bloomberg that commercial property values likely will not start to rise until mid 2021, taking a year to noticeably rebound.